1099 hourly rate to salary calculator

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. Online calculator should tell you taxes are 9134.

Payroll Calculator 2020 Deals 55 Off Www Ingeniovirtual Com

Carolina North Carolina Hourly Paycheck Calculator Change state Take home pay is.

. Adjusting- 91hr08 114hr on 1099 We have put together a calculator you can use here to calculate your personal hourly rate. Add that to SE taxes and youre at 18813 total taxes or a take-home of 49687. Payroll So Easy You Can Set It Up Run It Yourself.

Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary. Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the. With W-2 designated employees businesses are required by law to cover employer taxes roughly a 15 markup on salary depending on where the employee lives and.

Following is how to calculate yearly salary from hourly rate. Taxes Paid Filed - 100 Guarantee. If you get paid bi-weekly once every two weeks your gross paycheck will be 1077.

Just enter in a few details below to find out what. For example how does an annual salary as an employee translate to an hourly rate as a contractor. Of course knowing the 1099 vs.

I have worked with some who just use the rule. We use the most recent and accurate information. Read reviews on the premier Calculator Tools in the industry.

Use the IRSs Form 1040-ES as a worksheet to determine your. A 1099 contractor making 35hour would then expect to make about 3250hour 3510765. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Amount of pay hours. Ad See the Calculator Tools your competitors are already using - Start Now. Ad Easy To Run Payroll Get Set Up Running in Minutes.

For example for 5 hours a month at time. To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working. The exact equation they use depends on the type of tax form they have either W-2 or 1099.

Calculate your adjusted gross income from self-employment for the year. Enter your info to see your. Base Salary year.

Divide the rate by the hours 100 10 hours 10hour GROSS. This number is based on 375 hours of work per. Taxes Paid Filed - 100 Guarantee.

To convert your hourly wage to its equivalent salary use our calculator below. The rule of thumb is if the employee make 20 per hour their boss has to charge 40 per hour. Convert 1099 dollars an hour to yearly salary.

To decide your hourly salary divide your annual income with 2080. The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is. Time Worked Hours Per Day Days Per Week Starting Pay Computed Pay Exclude un-paid time.

This is a great exercise to come up with a. Use this easy calculator to convert an hourly wage to its equivalent as an annual salary. Generate your paystubs online in a few steps and have them emailed to you right away.

Next subtract your payroll and income taxes. Then a 1099 hourly. For a long-term contract on W-2 status with a workweek of 40 hours the calculations.

Here is how to calculate your quarterly taxes. 1099 vs W2 Income Breakeven Calculator. Ad Create professional looking paystubs.

The following steps show how to calculate gross pay for hourly wages. W-2 hourly rate difference is rarely so simple when an. Hourly rate equals annual salary.

30 is the standard but use your actual if you know it 10 X. So good - you net the same per year with 68500. Let us help you figure that out.

This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay. This salary calculator assumes the hourly and.

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Professional Templates Business Template

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator 2020 Clearance 52 Off Www Ingeniovirtual Com

Payroll Calculator Free Employee Payroll Template For Excel

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Calculator Free Employee Payroll Template For Excel

Free Payroll Calculator Cheap Sale 51 Off Www Ingeniovirtual Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Salary To Hourly Salary Converter Salary Hour Calculators

The Hourly Paycheck Calculator Netchex

How To Calculate Your 1099 Hourly Rate No Matter What You Do

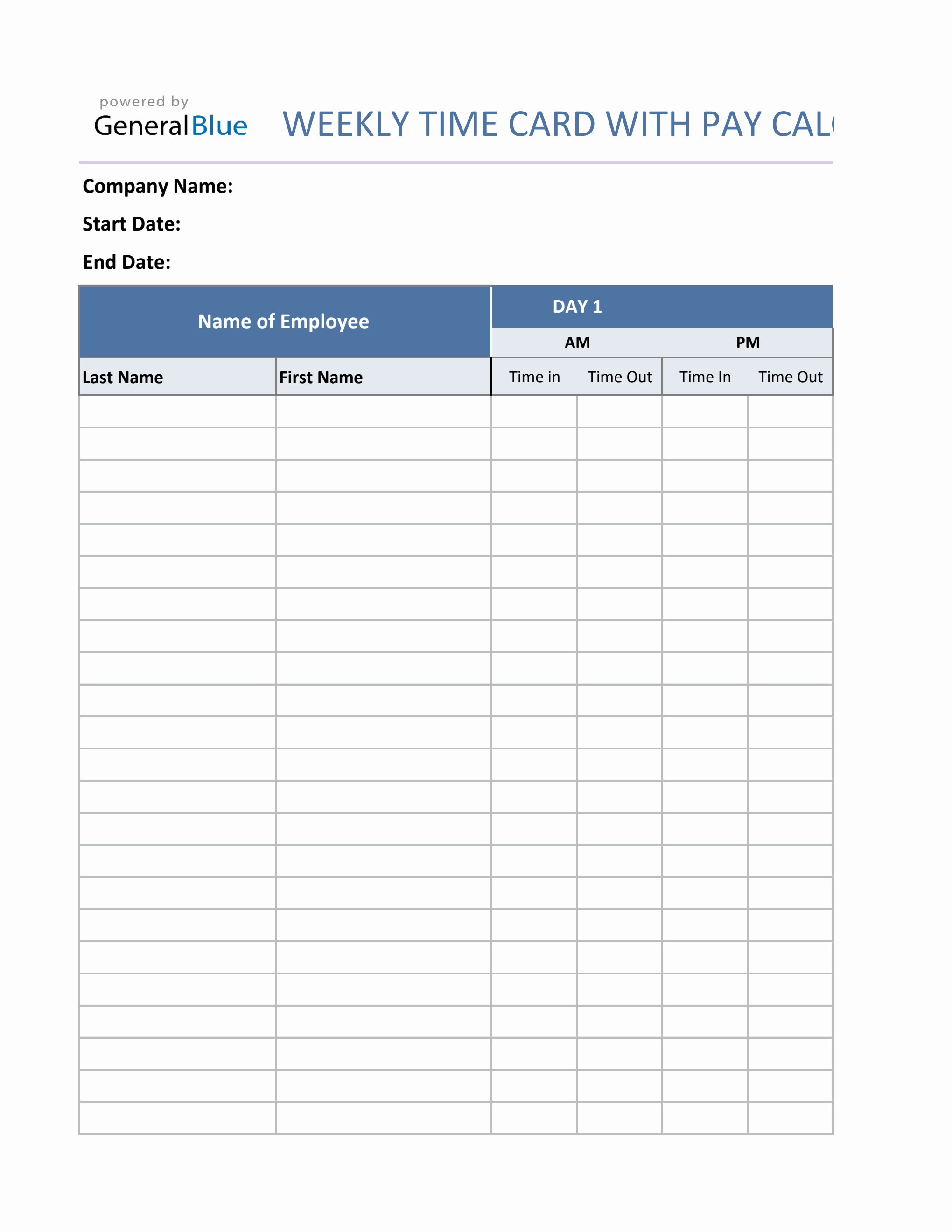

Weekly Timecard With Pay Calculation For Contractors In Excel

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps